Frequently Asked Questions (FAQs)

What is a Title?

When purchasing a home, instead of purchasing the actual building or land, you are really purchasing the title to the property - the right to occupy and use the space. A title is the evidence or right, which a person has to the ownership and possession of land. A defect in the title can be any legal right held by someone other than the owner to claim property or to make demands on the owner of that property. When you purchase real property, you will receive a written document (called "the deed") which transfers the ownership (title) of the property to you as the purchaser. The conveyance of real property is not complete until the deed is recorded with the county.

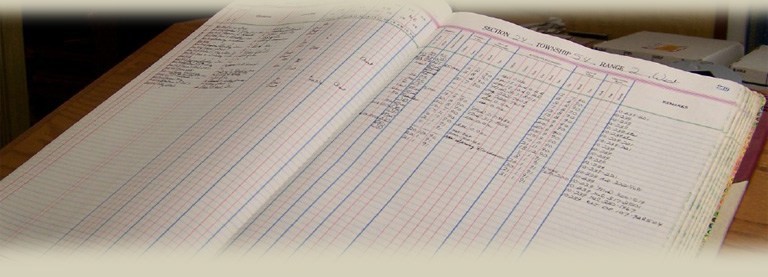

When you receive the deed, you record it with the county recorder in the county where the property is located. The purpose of recording the deed is to give "notice to the world" that you now have an ownership interest in that particular piece of real property. Recording also tracks the chronological chain of title. Anyone who wants to know who owns a piece of real property can check with the county recorder's office.

What Is Title Insurance?

Title insurance was developed to protect the parties involved in real estate transactions. Title Insurance is purchased with a low, one-time premium at closing, and is an insured statement of the condition of the title that protects the owner. It will cover you if a problem regarding title defects or legal ownership arises that was not discovered during the title search (for example, if an earlier deed was forged or had unknown mistakes, or that strip of back yard you thought you were buying actually belonged to someone else). The insurance provider guarantees you against loss due to any defect in title or expenses related to your legal defense. Although title problems are infrequent, they could result in the loss of your house or large legal fees, so it is wise to protect yourself. The mortgagee (lender) will most likely insist on title insurance to also protect their investment.

There are two types of title insurance:

- Owners Policy - An owner's policy insures that the title to the property is free from defects (liens and encumbrances), except those which are listed as exceptions in the policy. It is normally issued in the amount equal to the real estate purchase price and remains in effect for as long as the owner or their heirs retains an interest in the property. In addition to identifying risk before the transaction is completed, the Owners Policy will pay for costs stemming from claims made against your title.

- Loan/Mortgage/Lender Policy * - The lender's policy is separate from the owner's policy. It assures the validity and enforceability of the lien of the lender's mortgage or deed of trust and serves as protection for the lender’s security interest in the property. A Loan Policy is issued in the amount of the loan, and liability decreases as the mortgage debt is reduced.

Why Do I Need Title Insurance?

Title Insurance will protect you from financial loss in the event that problems develop regarding the rights to ownership of your property.

Before title insurance is issued, the title insurer performs a search on the title to determine whether any defects occurred in prior conveyances and transfers. Through the search and examination process, title problems are disclosed so they can be corrected whenever possible. However, even the most careful search process cannot locate all hidden title hazards. And in the unfortunate event that title defects are found after the search process, your title insurance policy will have you covered and protect you from financial loss. Claims against your property can be in made in over 70 forms. Examples include:

- Mistakes in deeds, wills, and trusts

- Forgeries in the chain of title

- Outstanding mortgages and judgments, or a lien against the property because the seller has not paid their taxes

- Easements that allow construction of a road or utility line

- Pending legal action against the property that could affect a purchaser

- A claim by a previous undisclosed relative of a former owner

You Have a Choice of who your Title Insurer will be!

Under RESPA, (Real Estate Settlement Procedures Act) the seller may not require a buyer, as a condition of the sale, to purchase title insurance from any particular title company.* However, the lender may require that you purchase title insurance from a reputable company. In most cases a home buyer can shop for and choose a company that meets the lender’s standards.

A lender's title insurance policy does not protect you if you are the purchaser. Before you go to closing, be sure to inquire about an owner's title insurance policy to protect your most important investment.

* "Housing and Urban Development Subtitle B – Regulations Relating to Housing and Urban Development Chapter XX – Office of Assistant Secretary for Housing – Federal Housing Commissioner, Department of Housing and Urban Development Part 3500 – Real Estate Settlement Procedures Act

24 CFR 3500.15: Affiliated Business Arrangements

... .(2) No person making a referral has required (as defined in 3500.2, 'required use') any person to use any particular provider of settlement services or business incident thereto, except if such person is a lender, for requiring a buyer, borrower or seller to pay for the services of an attorney, credit reporting agency, or real estate appraiser chosen by the lender to represent the lender’s interest in a real estate transaction, or except is such person is an attorney or law firm for arranging for issuance of a title insurance policy for a client, directly as agent or through a separate corporate title insurance agency that may be operated as an adjunct to the law practice of the attorney or law firm, as part of representation of that client in a real estate transaction.... .(2) No person making a referral has required (as defined in 3500.2, 'required use') any person to use any particular provider of settlement services or business incident thereto, except if such person is a lender, for requiring a buyer, borrower or seller to pay for the services of an attorney, credit reporting agency, or real estate appraiser chosen by the lender to represent the lender’s interest in a real estate transaction, or except is such person is an attorney or law firm for arranging for issuance of a title insurance policy for a client, directly as agent or through a separate corporate title insurance agency that may be operated as an adjunct to the law practice of the attorney or law firm, as part of representation of that client in a real estate transaction.

... .(c) Definitions. As used in this section:

... .(9) Person who is in a position to refer settlement service business means any real estate broker or agent, lender, mortgage broker, builder or developer, attorney, title company, title agent, or other person deriving a significant portion of his or her gross income from providing settlement services."

Protecting your Home Investment - How can I be sure my property is really mine?

A simple answer: Title insurance. The purchase of your home is usually the largest single investment you will ever make. When you purchase a home, you also purchase several types of insurance coverage to protect your home as well as your personal property. Homeowner's insurance protects against loss from fire, theft, or wind damage. Flood insurance protects homeowners against losses associated with flooding. Title insurance protects against hidden title hazards and defects that may threaten your financial investment in your home.

Title Insurance is different from other types of home insurance and is often misunderstood, but it is definitely just as important. Title insurance emphasizes on risk prevention rather than risk assumption and the coverage offers the best possible protection for yourself and your investment.